In an era where digital transformation is reshaping every aspect of business, the integration of artificial intelligence (AI) into tax functions is generating significant interest and considerable debate. Recently, we hosted a roundtable bringing together senior tax professionals to explore the opportunities, challenges, and practical realities of leveraging AI within the tax landscape. We also utilised the results from a survey completed by approximately 89 tax professionals on AI before the roundtable event.

The roundtable underscored the transformative potential of artificial intelligence within the tax domain, while also highlighting the significant challenges that organisations face in its adoption. Participants recognised that AI extends beyond basic research and translation functions, offering capabilities in predictive analytics, automated compliance, and advanced data mining.

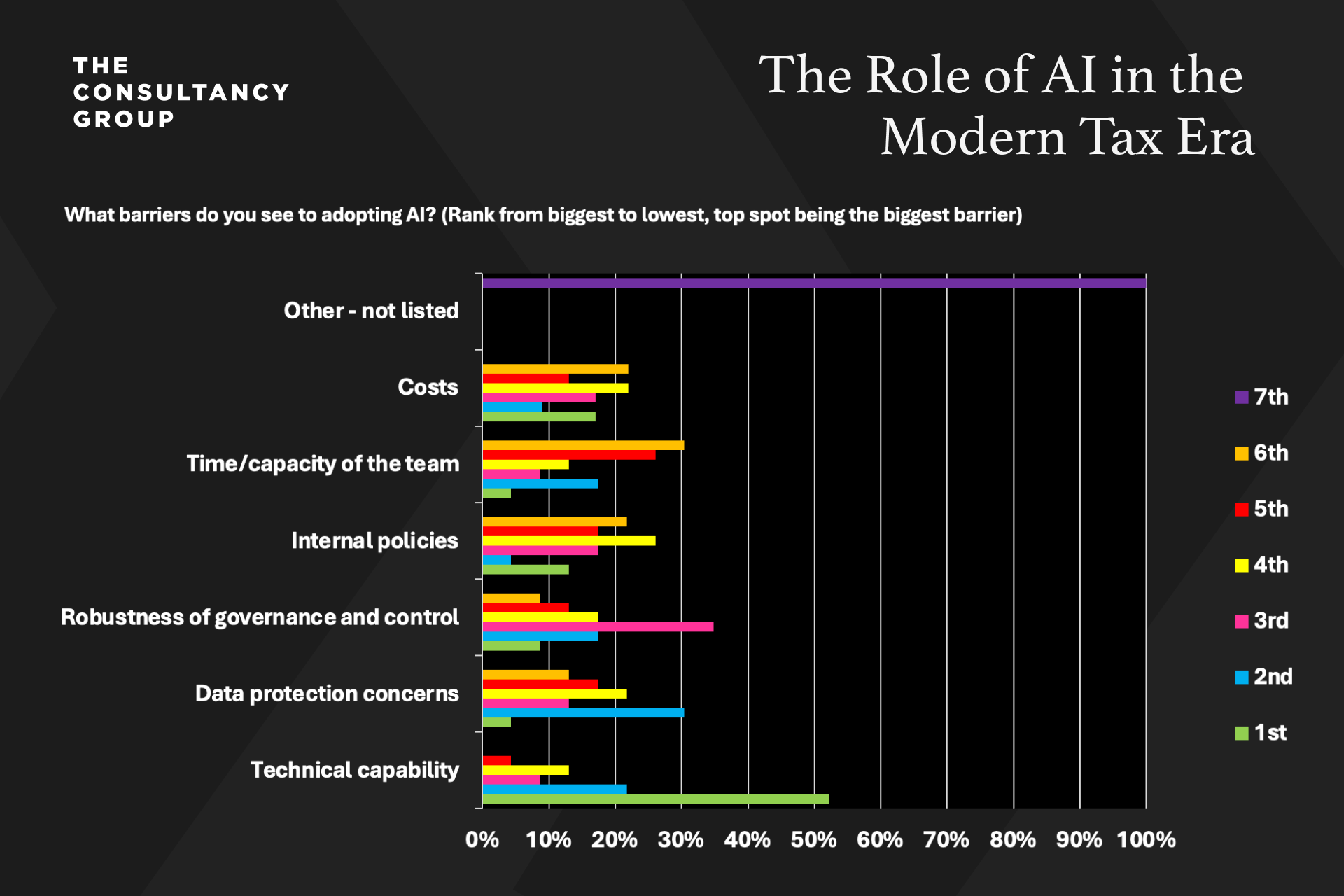

However, barriers such as limited technical capability, concerns over data security, internal policy restrictions, and a lack of trust in AI-generated outputs continue to impede widespread implementation.

One participant noted, “Cost was really low down because I think a lot of people aren't necessarily aware that the add-ons is where the element comes to it” illustrating that perceptions around AI investment remain uncertain.

The event showcased a broad spectrum of AI applications currently under exploration or deployment, including:

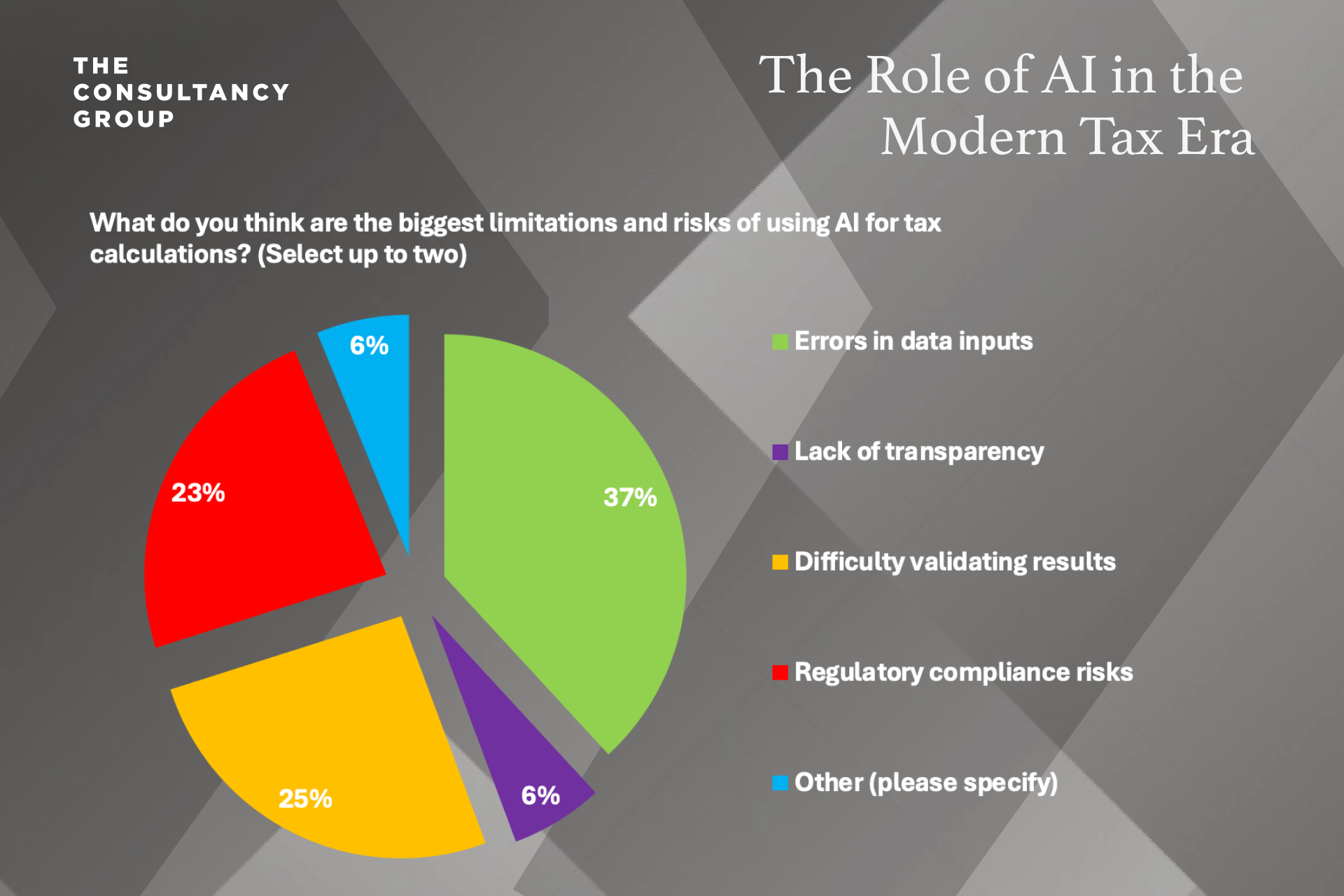

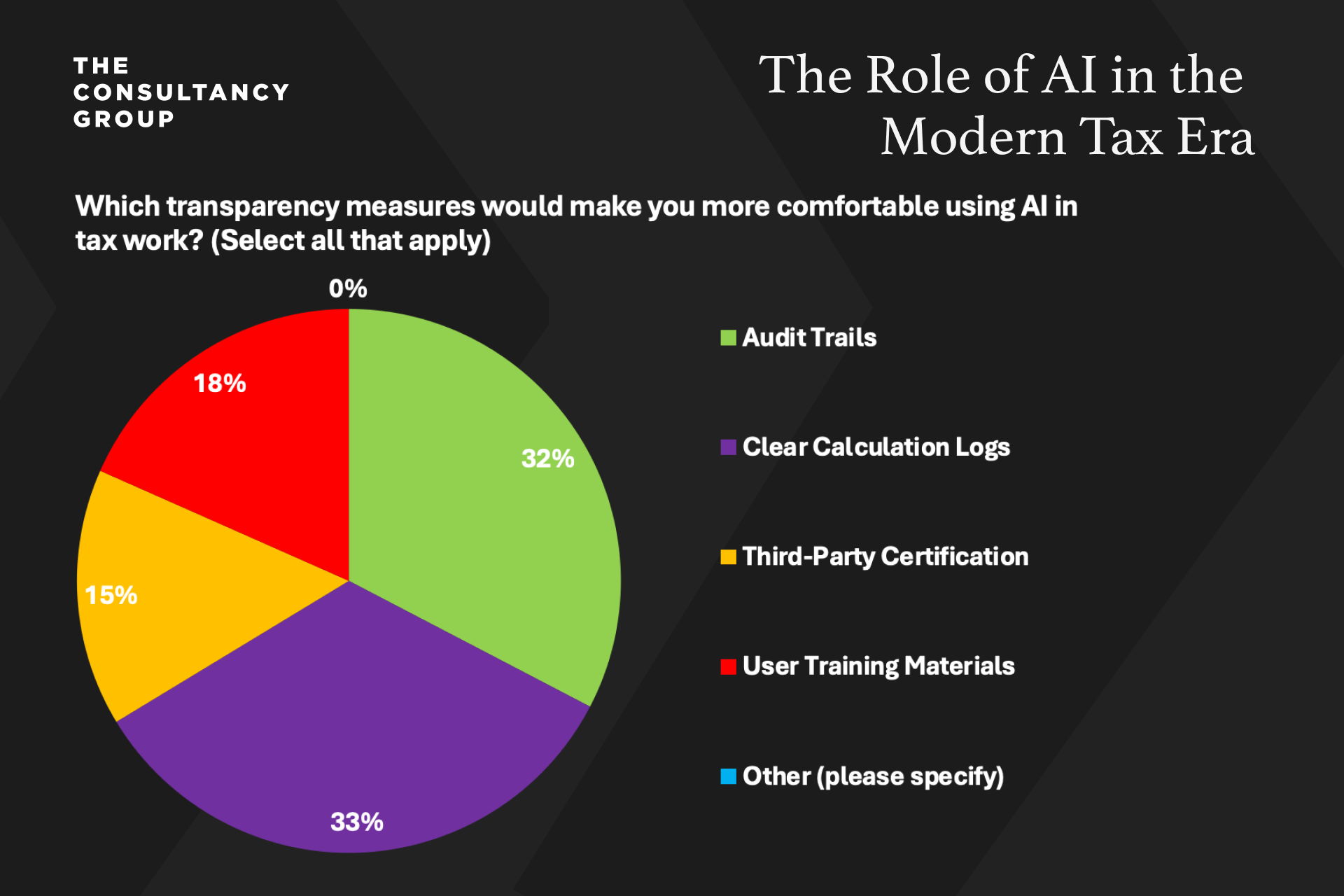

Robust governance frameworks and responsible AI deployment emerged as critical themes. Participants discussed the importance of internal policies, ongoing staff training, and internal controls to mitigate risks associated with AI. Concerns centred on data security, privacy, and the accuracy of AI outputs. One attendee remarked, “You can't trust the data and the other part here... AI will go, I can't give you blank space. Make this look good” emphasising the necessity of maintaining oversight and verifying AI-generated information. Many organisations are establishing or refining policies to oversee AI use, often involving dedicated responsible AI teams. A participant stated, “We have an AI policy of responsible AI team licence, which is a starting point for our AI journey,” reflecting a proactive approach to governance.

A notable disconnect was identified between the perceived capabilities of AI and the level of organisational awareness about its true potential. Many stakeholders, ranging from senior leadership to operational teams, continue to view AI primarily as a research assistant or translation tool, often limited to automating routine tasks like document summarisation or language translation. This narrow perception prevents organisations from fully recognising AI’s broader strategic applications, such as predictive analytics, scenario modelling, real-time compliance monitoring, and decision support systems that can fundamentally transform how they operate and compete.

This gap in understanding hampers confident adoption, leading to hesitancy, underinvestment, or misaligned expectations. It also fosters scepticism among staff who may view AI initiatives as superficial or as threats to their roles, rather than as tools for augmentation and strategic advantage. Such perceptions can result in resistance to change and a reluctance to prioritise AI-driven projects.

Addressing this messaging gap is therefore critical, as one attendee said “The messaging can’t just be about efficiency. That makes people feel like they’re being replaced.” It requires targeted education and awareness initiatives designed to demonstrate AI’s full spectrum of capabilities, success stories, and tangible benefits in the context of organisational goals. Developing clear communication strategies, highlighting how AI can support strategic decision-making, improve efficiency, and create competitive advantages, can help align perceptions and foster a culture of innovation. Only through such efforts can organisations unlock AI’s full potential, ensuring it is embraced as a transformative force rather than viewed narrowly or sceptically.

The roundtable identified several critical themes essential for successfully integrating AI into tax functions:

Trust and Reliability: Trust remains a central concern. Ensuring high-quality, accurate data, and establishing clear governance frameworks are vital to foster confidence in AI outputs. As one participant emphasised, “The biggest barrier is technical capability, and trust in the data.”

Collectively, these themes underscore that while AI offers transformative opportunities, organisations must navigate technical, regulatory, and organisational hurdles thoughtfully to harness its full potential responsibly.

This roundtable has underscored the significant opportunities AI presents for transforming tax functions, from automating routine tasks to enabling advanced predictive analytics. Participants shared practical use cases, such as legislative summarisation, content generation, and scenario planning, demonstrating AI’s potential to improve efficiency and support strategic decision-making.

At the same time, the discussion highlighted critical challenges that must be addressed to unlock AI’s full benefits. These include ensuring data quality, establishing effective governance frameworks, and fostering organisational trust. Concerns over data security, regulatory compliance, and the costs of deployment remain key considerations moving forward.

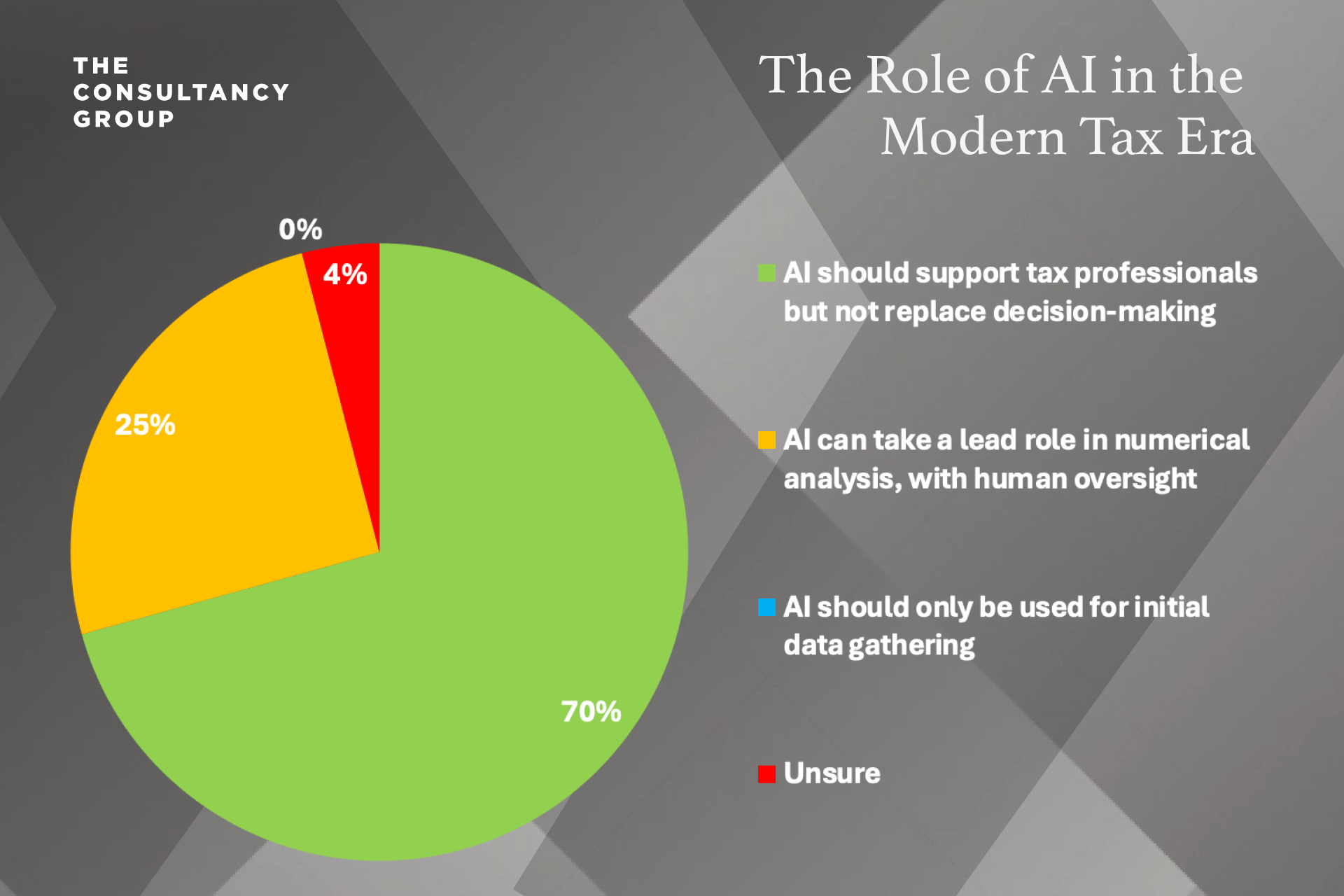

The consensus was clear: AI should be viewed as a supportive tool that enhances human expertise rather than replacing it. For organisations to succeed, they must prioritise responsible implementation, invest in ongoing training, and adopt a collaborative approach to innovation. Recognising that AI is not a one-time project but an ongoing journey, organisations need to focus on developing internal capabilities, establishing responsible governance frameworks, and exploring scalable solutions that can be integrated across functions, including tax, legal, and finance.

What works for finance may not be fit for purpose for tax, and vice versa; continuous education and strategic experimentation will be vital to unlocking AI’s transformative potential responsibly.

As I reflect on this discussion, I remain convinced that the future of AI in tax hinges on the collective ability of tax professionals to navigate its challenges thoughtfully, while harnessing its immense capabilities for positive impact. Participants agreed that “This isn’t a one-time thing; it’s a journey to understand and harness AI’s potential responsibly.”

We’ll be refining the AI in Tax survey to reflect emerging priorities

Want to Be Part of the Next Conversation?

Email bethany AT consultancygroup.com to join the conversation.

In the spirit of AI we fed this report into Lovable and got it to automatically create a microsite for our full survey and roundtable results (which took just a few minutes). You can check them out here.